Filing IRS Form 1098 Online

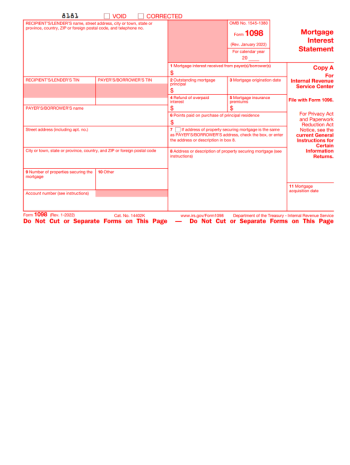

Managing your taxes can be a complex process, particularly when accounting for mortgage interest payments. For homeowners and taxpayers in the United States, the Internal Revenue Service (IRS) provides a form that is essential for reporting these expenses - the IRS Form 1098. This document is designed to report the amount of interest and related expenses paid on a mortgage within the tax year to the IRS and to the person who paid the interest.

The Advantages of a Fillable 1098 Mortgage Form

In recent years, the IRS has moved towards accommodating the electronic filing (e-filing) of tax documents. Among these documents is the fillable IRS Form 1098, which offers several advantages to taxpayers. The primary benefit of utilizing the fillable version is accessibility; individuals can easily download, complete, and submit the form without the need for printing or mailing physical copies. This convenience significantly reduces the time spent managing paper documents and improves tax filing efficiency.

Fillable 1098 Form for 2023

Taxpayers seeking the latest IRS 1098 fillable form can find it directly on the IRS's official website. It is crucial to obtain the form from a reliable source to ensure it's the correct version for the corresponding tax year. The official IRS website provides the most up-to-date and accurate forms free of charge, assuring compatibility with current tax laws and e-filing systems.

How to Complete the Fillable 1098 Form

Completing the fillable 2023 1098 mortgage interest form online is a straightforward process. Here’s a step-by-step guide to assist you:

- Access the Form

Use our website to obtain the latest version of the fillable 1098 form. Ensure you are using the 2023 version to reflect the proper tax year. - Enter Information

Fill in the required fields with accurate information. This includes lender and borrower details, the account number, and the amount of interest received during the tax year. - Review

After entering all necessary data, review the copy carefully for any mistakes or omissions. Accuracy is essential to prevent any delays or issues with your tax processing. - Submit

Once you're satisfied with the information entered, follow the instructions provided by the IRS for submitting the statement electronically. Filing online ensures quick processing and confirmation of receipt by the IRS.

Additional Features and Benefits

Using the fillable 1098 mortgage interest form for 2023 via an electronic platform can also offer added features such as automatic calculations, error checks, and the ability to save and return to your work at a later time. This enhanced functionality minimizes the risk of errors and allows for a more accurate and manageable tax filing experience.

Addressing Common Concerns with Online Filing

Despite the many advantages of e-filing, some taxpayers may have reservations about transitioning from paper forms. Concerns often relate to data security and the fear of making mistakes online. The IRS has robust security measures in place to protect taxpayer information. Moreover, the error-checking features of electronic forms can actually decrease the likelihood of mistakes, providing peace of mind for those filing their taxes digitally.

By making use of the fillable 1098 form for 2023, taxpayers can simplify their filing process, ensuring that they meet their tax obligations with greater ease and accuracy.

Related Forms

-

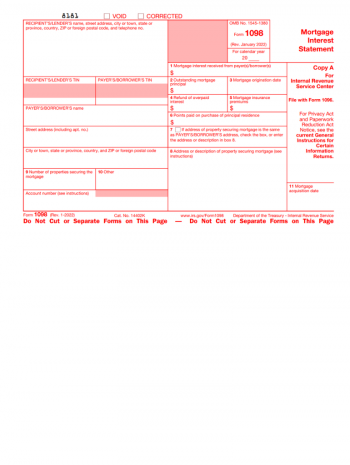

![image]() 1098 IRS Form 1098 is an essential document that serves as a mortgage interest statement for taxpayers in the United States. It is issued by a mortgage lender to the borrower detailing the amount of interest and related expenses paid on a mortgage during the tax year. This information is crucial for homeowners as it can allow them to claim deductions on their federal income tax returns, thus potentially reducing their taxable earnings. Lenders must send out federal income tax form 1098 to borrowers w... Fill Now

1098 IRS Form 1098 is an essential document that serves as a mortgage interest statement for taxpayers in the United States. It is issued by a mortgage lender to the borrower detailing the amount of interest and related expenses paid on a mortgage during the tax year. This information is crucial for homeowners as it can allow them to claim deductions on their federal income tax returns, thus potentially reducing their taxable earnings. Lenders must send out federal income tax form 1098 to borrowers w... Fill Now -

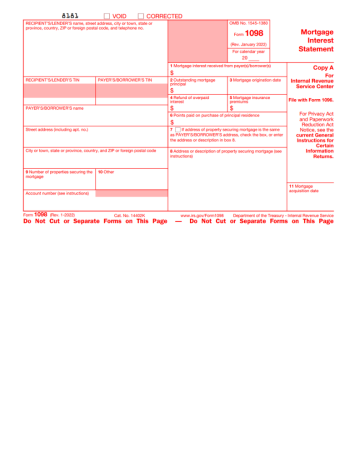

![image]() Form 1098 Instructions Navigating the world of taxes can be a daunting task, especially when dealing with specific IRS forms like Form 1098. This document, commonly referred to as the "Mortgage Interest Statement," is utilized by those who are paying interest on a mortgage, and it plays a crucial role in your annual tax filing. We'll explore the essential details and provide guidance on the instructions for Form 1098 to make your tax filing process smoother. Who Needs to File Form 1098? Form 1098 is filed by the entity that receives mortgage interest payments of $600 or more during a tax year. Typically, this is your mortgage lender or servicer. They provide both the Internal Revenue Service and the borrower with the amount of interest paid throughout the year, which can often be claimed as a deduction if you itemize on your tax return. Details Contained Within Form 1098 This document will not only show the total interest paid but may also include other relevant financial details, such as points paid to obtain the mortgage and, in some cases, property tax payments that the lender collects and pays from an escrow account. For the borrower, these figures are pivotal as they can significantly impact taxable income. However, individuals need to be aware of the 1098 filing instructions to ensure their mortgage interest is reported correctly and the potential deductions are maximized. It's important to confirm that the information provided by the lender is accurate and corresponds to your financial records. Navigating the Instructions for Form 1098 The document comes with a comprehensive set of instructions that assist lenders in accurately completing the form. These 1098 IRS instructions detail the requirements for reporting mortgage interest, the threshold for reporting, and other nuanced scenarios such as co-borrower situations and multiple properties. Given the possibility of legislative changes each year, recipients of the form should be vigilant and verify if there have been any recent updates to the rules that could affect their interest deduction claims. These updates can be found in the instructions that accompany the form or on our website. Troubleshooting Common Issues Taxpayers often encounter confusion surrounding second mortgages, home equity lines of credit, or refinanced loans. It's crucial to understand that these can also be subject to Form 1098 reporting and, therefore, must be carefully reviewed. Additionally, distinguish between personal property and real estate, as this may affect your ability to claim the interest deduction. Tips for Accurate Compliance Double-check the figures provided on Form 1098 against your own financial records. If you spot discrepancies, reach out to your lender to rectify them before filing. Ensure that you use the correct version of the form, adhering to any updates or revisions detailed in Form 1098 with instructions in PDF, often found online. While electronic filing is frequently the most convenient, don't overlook the option to file a paper copy if that's what suits your situation best. In summary, understanding Form 1098 and mortgage interest instructions is vital for any taxpayer with a mortgage. By following the guidelines laid out in the instructions and double-checking your lender's inputs, you can navigate your mortgage interest deductions successfully. For additional clarity and guidance, consider consulting with a tax professional well-versed in these matters. Fill Now

Form 1098 Instructions Navigating the world of taxes can be a daunting task, especially when dealing with specific IRS forms like Form 1098. This document, commonly referred to as the "Mortgage Interest Statement," is utilized by those who are paying interest on a mortgage, and it plays a crucial role in your annual tax filing. We'll explore the essential details and provide guidance on the instructions for Form 1098 to make your tax filing process smoother. Who Needs to File Form 1098? Form 1098 is filed by the entity that receives mortgage interest payments of $600 or more during a tax year. Typically, this is your mortgage lender or servicer. They provide both the Internal Revenue Service and the borrower with the amount of interest paid throughout the year, which can often be claimed as a deduction if you itemize on your tax return. Details Contained Within Form 1098 This document will not only show the total interest paid but may also include other relevant financial details, such as points paid to obtain the mortgage and, in some cases, property tax payments that the lender collects and pays from an escrow account. For the borrower, these figures are pivotal as they can significantly impact taxable income. However, individuals need to be aware of the 1098 filing instructions to ensure their mortgage interest is reported correctly and the potential deductions are maximized. It's important to confirm that the information provided by the lender is accurate and corresponds to your financial records. Navigating the Instructions for Form 1098 The document comes with a comprehensive set of instructions that assist lenders in accurately completing the form. These 1098 IRS instructions detail the requirements for reporting mortgage interest, the threshold for reporting, and other nuanced scenarios such as co-borrower situations and multiple properties. Given the possibility of legislative changes each year, recipients of the form should be vigilant and verify if there have been any recent updates to the rules that could affect their interest deduction claims. These updates can be found in the instructions that accompany the form or on our website. Troubleshooting Common Issues Taxpayers often encounter confusion surrounding second mortgages, home equity lines of credit, or refinanced loans. It's crucial to understand that these can also be subject to Form 1098 reporting and, therefore, must be carefully reviewed. Additionally, distinguish between personal property and real estate, as this may affect your ability to claim the interest deduction. Tips for Accurate Compliance Double-check the figures provided on Form 1098 against your own financial records. If you spot discrepancies, reach out to your lender to rectify them before filing. Ensure that you use the correct version of the form, adhering to any updates or revisions detailed in Form 1098 with instructions in PDF, often found online. While electronic filing is frequently the most convenient, don't overlook the option to file a paper copy if that's what suits your situation best. In summary, understanding Form 1098 and mortgage interest instructions is vital for any taxpayer with a mortgage. By following the guidelines laid out in the instructions and double-checking your lender's inputs, you can navigate your mortgage interest deductions successfully. For additional clarity and guidance, consider consulting with a tax professional well-versed in these matters. Fill Now -

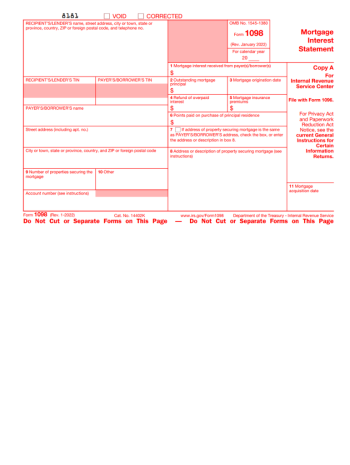

![image]() Printable 1098 Form At the close of each tax year, it becomes imperative for individuals to prepare and organize various tax documents. One such document is the IRS Form 1098, also known as the Mortgage Interest Statement. This form is crucial for anyone who has paid mortgage interest during the tax year, as it can provide potential tax deductions on your federal income tax return. The form details the amount of interest and related expenses you have paid on a mortgage, and it must be submitted to the IRS along with your other tax information. For homeowners, lenders typically send a copy of Form 1098 by January 31st, which shows the interest paid on a mortgage in the previous year. However, if you do not receive this form or if you need additional copies, the printable 1098 form for 2023 can be accessed easily and filled out as needed. Getting the 1098 Form for 2023 To ensure that every taxpayer has convenient access to necessary tax forms, the IRS provides free downloadable and printable versions of their documents online. To locate a blank 1098 printable form, visit our website and navigate to the forms and publications section. Here, you will find the newest version of the form for the relevant tax year - ensuring that you're always up-to-date with any changes in tax rules or formats. Once downloaded, the IRS Form 1098 printable for 2023 must be filled out with accurate information to avoid any complications or delays in your tax processing. It's important to make sure each section is completed correctly, as this data will directly affect your tax calculations. Filling Out the 1098 Tax Form When using a printable free 1098 template, take note of the critical areas that require your attention. The form will request the name, address, and taxpayer identification number of both the payer of the mortgage interest and the recipient. Additionally, it will have sections to input the amount of mortgage interest received by the lender, points paid on the purchase of a principal residence, and - where applicable - insurance premiums or refunds. It is essential to double-check each piece of information for accuracy, as any discrepancies could raise red flags with the IRS. Verify the mortgage interest amount with your lender's records to ensure that the sum reported on Form 1098 matches your actual payments. As for personal information, ensure names and identification numbers are spelled and entered correctly to avoid issues with your tax return. Best Practices and Common Mistakes Employing due diligence when preparing your tax documents is always advised. For instance, do not attempt to write off more interest than you have actually paid, as this might lead to an audit or penalty. Furthermore, do not overlook the printable 1098 form for 2023 if you're eligible to itemize deductions, as it could significantly reduce your taxable income. Common mistakes include the following: leaving fields incomplete, entering information on the wrong line, misunderstanding the type of interest that can be reported. For instance, personal interest or interest from a credit card for non-housing-related expenses should not be included. While the task of tax preparation might seem daunting, tools like the printable 1098 form for 2023 are designed to aid taxpayers in reporting their mortgage interest accurately and efficiently. Take advantage of these resources and ensure you consult with a tax professional if you have any uncertainties before filing. Fill Now

Printable 1098 Form At the close of each tax year, it becomes imperative for individuals to prepare and organize various tax documents. One such document is the IRS Form 1098, also known as the Mortgage Interest Statement. This form is crucial for anyone who has paid mortgage interest during the tax year, as it can provide potential tax deductions on your federal income tax return. The form details the amount of interest and related expenses you have paid on a mortgage, and it must be submitted to the IRS along with your other tax information. For homeowners, lenders typically send a copy of Form 1098 by January 31st, which shows the interest paid on a mortgage in the previous year. However, if you do not receive this form or if you need additional copies, the printable 1098 form for 2023 can be accessed easily and filled out as needed. Getting the 1098 Form for 2023 To ensure that every taxpayer has convenient access to necessary tax forms, the IRS provides free downloadable and printable versions of their documents online. To locate a blank 1098 printable form, visit our website and navigate to the forms and publications section. Here, you will find the newest version of the form for the relevant tax year - ensuring that you're always up-to-date with any changes in tax rules or formats. Once downloaded, the IRS Form 1098 printable for 2023 must be filled out with accurate information to avoid any complications or delays in your tax processing. It's important to make sure each section is completed correctly, as this data will directly affect your tax calculations. Filling Out the 1098 Tax Form When using a printable free 1098 template, take note of the critical areas that require your attention. The form will request the name, address, and taxpayer identification number of both the payer of the mortgage interest and the recipient. Additionally, it will have sections to input the amount of mortgage interest received by the lender, points paid on the purchase of a principal residence, and - where applicable - insurance premiums or refunds. It is essential to double-check each piece of information for accuracy, as any discrepancies could raise red flags with the IRS. Verify the mortgage interest amount with your lender's records to ensure that the sum reported on Form 1098 matches your actual payments. As for personal information, ensure names and identification numbers are spelled and entered correctly to avoid issues with your tax return. Best Practices and Common Mistakes Employing due diligence when preparing your tax documents is always advised. For instance, do not attempt to write off more interest than you have actually paid, as this might lead to an audit or penalty. Furthermore, do not overlook the printable 1098 form for 2023 if you're eligible to itemize deductions, as it could significantly reduce your taxable income. Common mistakes include the following: leaving fields incomplete, entering information on the wrong line, misunderstanding the type of interest that can be reported. For instance, personal interest or interest from a credit card for non-housing-related expenses should not be included. While the task of tax preparation might seem daunting, tools like the printable 1098 form for 2023 are designed to aid taxpayers in reporting their mortgage interest accurately and efficiently. Take advantage of these resources and ensure you consult with a tax professional if you have any uncertainties before filing. Fill Now -

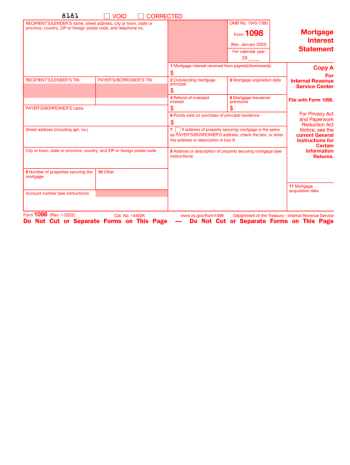

![image]() IRS Form 1098 As a knowledgeable professional, it's crucial to understand the intricacies of the IRS Form 1098 template, especially with the arrival of the 2023 tax year. This form, commonly known as the "Mortgage Interest Statement," is integral for both lenders and homeowners alike. Its primary purpose is to report the amount of interest and related expenses paid on a mortgage within the tax year. Comprehensive knowledge of Form 1098 is essential in ensuring accurate reporting and maximizing potential tax deductions. IRS Tax Form 1098 & Mandatory Filing Requirements For anyone required to file 1098 IRS documentation, it is mandatory for any entity that receives interest from a borrower exceeding $600 during the tax year. Lenders, such as banks or financial institutions, are typically responsible for filing this form. It's important to note that individual taxpayers who receive mortgage interest payments may also have this requirement under certain conditions. Being well-informed about the filing obligations is a critical component of tax compliance. Federal Form 1098: Deadlines & Key Dates Awareness of the deadlines for submitting IRS Form 1098 is critical. This document must be filed with the IRS by January 31, following the calendar year of mortgage interest collection. Simultaneously, a copy of the form must be provided to the individual taxpayer who paid the interest to inform them of the deductible amount they can report on their tax return. Notable Exceptions and Special Circumstances There are exceptions and special circumstances mitigating the need for Form 1098. One such instance is when the interest paid by the individual does not exceed $600 within the tax year. In these scenarios, issuance of Form 1098 is not obligatory. Nonetheless, taxpayers can still deduct eligible mortgage interest, provided they have the necessary supporting documentation. Accessibility of Form 1098 Accessibility to the necessary forms is paramount for compliance. To assist with this, our dedicated website offers a free IRS Form 1098, easily downloadable for personal or professional use. This blank template can help streamline the process of preparing, filing, and providing the form to the relevant parties. Conclusive Advice for Taxpayers and Professionals Whether you are preparing your taxes or assisting others, having access to the IRS Form 1098 in PDF format can greatly simplify the procedure. Anyone seeking further guidance can find an abundance of resources and support through our website or by contacting a tax advisor. Remember that professional advice is especially beneficial in navigating complex situations or understanding the broader implications of tax law changes. To conclude, the 1098 IRS tax form is vital for reporting mortgage interest and should be handled with care and precision. For the 2023 tax year, stay updated on the latest IRS regulations, file within the set deadlines, and use all available resources to execute this task as smoothly as possible. Fill Now

IRS Form 1098 As a knowledgeable professional, it's crucial to understand the intricacies of the IRS Form 1098 template, especially with the arrival of the 2023 tax year. This form, commonly known as the "Mortgage Interest Statement," is integral for both lenders and homeowners alike. Its primary purpose is to report the amount of interest and related expenses paid on a mortgage within the tax year. Comprehensive knowledge of Form 1098 is essential in ensuring accurate reporting and maximizing potential tax deductions. IRS Tax Form 1098 & Mandatory Filing Requirements For anyone required to file 1098 IRS documentation, it is mandatory for any entity that receives interest from a borrower exceeding $600 during the tax year. Lenders, such as banks or financial institutions, are typically responsible for filing this form. It's important to note that individual taxpayers who receive mortgage interest payments may also have this requirement under certain conditions. Being well-informed about the filing obligations is a critical component of tax compliance. Federal Form 1098: Deadlines & Key Dates Awareness of the deadlines for submitting IRS Form 1098 is critical. This document must be filed with the IRS by January 31, following the calendar year of mortgage interest collection. Simultaneously, a copy of the form must be provided to the individual taxpayer who paid the interest to inform them of the deductible amount they can report on their tax return. Notable Exceptions and Special Circumstances There are exceptions and special circumstances mitigating the need for Form 1098. One such instance is when the interest paid by the individual does not exceed $600 within the tax year. In these scenarios, issuance of Form 1098 is not obligatory. Nonetheless, taxpayers can still deduct eligible mortgage interest, provided they have the necessary supporting documentation. Accessibility of Form 1098 Accessibility to the necessary forms is paramount for compliance. To assist with this, our dedicated website offers a free IRS Form 1098, easily downloadable for personal or professional use. This blank template can help streamline the process of preparing, filing, and providing the form to the relevant parties. Conclusive Advice for Taxpayers and Professionals Whether you are preparing your taxes or assisting others, having access to the IRS Form 1098 in PDF format can greatly simplify the procedure. Anyone seeking further guidance can find an abundance of resources and support through our website or by contacting a tax advisor. Remember that professional advice is especially beneficial in navigating complex situations or understanding the broader implications of tax law changes. To conclude, the 1098 IRS tax form is vital for reporting mortgage interest and should be handled with care and precision. For the 2023 tax year, stay updated on the latest IRS regulations, file within the set deadlines, and use all available resources to execute this task as smoothly as possible. Fill Now -

![image]() Form 1098: Mortgage Interest As a homeowner with a mortgage, it's important to understand the IRS 1098 mortgage form that comes into play during tax season. This document, officially named the Mortgage Interest Statement, serves a significant purpose in enabling homeowners to claim deductions on their tax returns. To begin, let's dive into the basics of what Form 1098 entails and how it affects your taxation matters. The 1098 mortgage statement is a tax form that lenders send to borrowers if they pay at least $600 in mortgage interest during the tax year. For many new and not-so-experienced homeowners, it is vital to know that receiving this document from your lender is not something to overlook, as it can lead to valuable tax deductions. Here's a simple real-life example to illustrate its use. The 1098 Statement & Related Forms If the taxpayer is itemizing deductions to claim mortgage interest, Schedule A is typically attached to Form 1040. This form details various itemized deductions, including mortgage interest. Form 1096 is used to summarize information from certain types of information returns, including Form 1098. In some cases, a copy of Form 1096 may need to be attached when filing with the IRS. If the taxpayer claims the Mortgage Interest Credit, they may need to attach Form 8862. In certain situations, the IRS may request verification of the information reported on 1098. Form 4506-T is used to request a tax return transcript, which can be attached as supporting documentation. If the taxpayer made a noncash charitable contribution, and the mortgage interest is related to a property obtained through such a contribution, Form 8283 may need to be attached. Example of Involving IRS Form 1098 Imagine Sarah, who purchased her first home in January of 2021. Throughout the year, she paid monthly mortgage payments, including interest on her loan. At the beginning of 2022, Sarah received her Form 1098 from the bank, which indicated that she had paid $7,500 in mortgage interest. Sarah can use this information when filing her taxes to potentially reduce her taxable income potentially, hence paying less in taxes, thanks to the mortgage interest deduction. To print Form 1098 for mortgage interest reporting, a taxpayer should receive it by mail from their lender. However, if for some reason it's not received or misplaced, one can often access it online through their lender's portal. Some may also be able to request a printed copy again if needed. Filing Your Taxes with Form 1098 When it's time to file Form 1098 for mortgage interest, the process is relatively straightforward. Individuals will input the total interest paid throughout the year, as reported on 1098, onto their Schedule A of Form 1040 if they are itemizing deductions. It's important to consult with a tax professional if you're unsure about itemizing, as this could substantially impact the value of your potential deductions. Now, let's consider an instance that pertains to Form 1098: mortgage interest example. Take John and Rachel, a married couple with a sizable home loan carrying a 4% interest rate. In 2021, they paid $12,000 in interest. When tax time arrives, their Form 1098 reflects this amount, which they can include as an itemized deduction, potentially lowering their taxable income by that same amount. For couples like John and Rachel, understanding and leveraging this form can make a notable difference in their annual tax obligations. As you face various financial decisions related to your home mortgage, remember the significance of the IRS 1098 mortgage form. Its proper use can lead to considerable tax benefits, making it a valuable document to watch out for and use correctly. Always consult a tax professional for personalized advice, ensuring you optimize your deductions while fully complying with IRS regulations. Fill Now

Form 1098: Mortgage Interest As a homeowner with a mortgage, it's important to understand the IRS 1098 mortgage form that comes into play during tax season. This document, officially named the Mortgage Interest Statement, serves a significant purpose in enabling homeowners to claim deductions on their tax returns. To begin, let's dive into the basics of what Form 1098 entails and how it affects your taxation matters. The 1098 mortgage statement is a tax form that lenders send to borrowers if they pay at least $600 in mortgage interest during the tax year. For many new and not-so-experienced homeowners, it is vital to know that receiving this document from your lender is not something to overlook, as it can lead to valuable tax deductions. Here's a simple real-life example to illustrate its use. The 1098 Statement & Related Forms If the taxpayer is itemizing deductions to claim mortgage interest, Schedule A is typically attached to Form 1040. This form details various itemized deductions, including mortgage interest. Form 1096 is used to summarize information from certain types of information returns, including Form 1098. In some cases, a copy of Form 1096 may need to be attached when filing with the IRS. If the taxpayer claims the Mortgage Interest Credit, they may need to attach Form 8862. In certain situations, the IRS may request verification of the information reported on 1098. Form 4506-T is used to request a tax return transcript, which can be attached as supporting documentation. If the taxpayer made a noncash charitable contribution, and the mortgage interest is related to a property obtained through such a contribution, Form 8283 may need to be attached. Example of Involving IRS Form 1098 Imagine Sarah, who purchased her first home in January of 2021. Throughout the year, she paid monthly mortgage payments, including interest on her loan. At the beginning of 2022, Sarah received her Form 1098 from the bank, which indicated that she had paid $7,500 in mortgage interest. Sarah can use this information when filing her taxes to potentially reduce her taxable income potentially, hence paying less in taxes, thanks to the mortgage interest deduction. To print Form 1098 for mortgage interest reporting, a taxpayer should receive it by mail from their lender. However, if for some reason it's not received or misplaced, one can often access it online through their lender's portal. Some may also be able to request a printed copy again if needed. Filing Your Taxes with Form 1098 When it's time to file Form 1098 for mortgage interest, the process is relatively straightforward. Individuals will input the total interest paid throughout the year, as reported on 1098, onto their Schedule A of Form 1040 if they are itemizing deductions. It's important to consult with a tax professional if you're unsure about itemizing, as this could substantially impact the value of your potential deductions. Now, let's consider an instance that pertains to Form 1098: mortgage interest example. Take John and Rachel, a married couple with a sizable home loan carrying a 4% interest rate. In 2021, they paid $12,000 in interest. When tax time arrives, their Form 1098 reflects this amount, which they can include as an itemized deduction, potentially lowering their taxable income by that same amount. For couples like John and Rachel, understanding and leveraging this form can make a notable difference in their annual tax obligations. As you face various financial decisions related to your home mortgage, remember the significance of the IRS 1098 mortgage form. Its proper use can lead to considerable tax benefits, making it a valuable document to watch out for and use correctly. Always consult a tax professional for personalized advice, ensuring you optimize your deductions while fully complying with IRS regulations. Fill Now